Finance Minister Nirmala Sitharaman on Tuesday received dividend payouts worth ₹5,304 crore from three state-owned banks, representing their financial contribution for the year ending March 31, 2025.

Managing Director and Chief Executive of Punjab National Bank Ashok Chandra presented a cheque worth ₹2,335 crore to the Finance Minister at her North Block office.

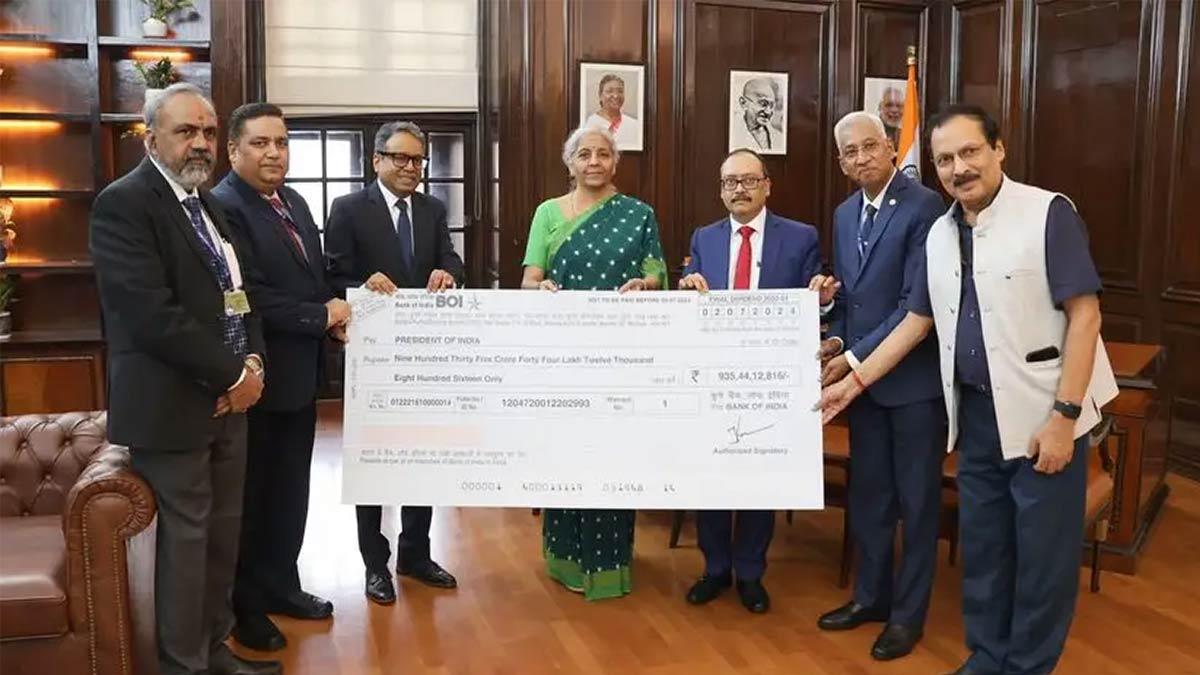

This was then followed by Bank of India MD & CEO Rajneesh Karnatak, who handed over a dividend of ₹1,353 crore. Indian Bank's MD & CEO Binod Kumar handed over the third cheque, worth ₹1,616 crore. These are in addition to the recent dividend payments by other large companies of public sector banks, comprising ₹8,076.84 crore by State Bank of India and ₹2,762 crore by Bank of Baroda last month.

India’s leading public sector enterprises, especially in finance, power, and energy, posted strong earnings in the final quarter of FY 2024-25, reinforcing the government’s fiscal strength.

SBI and the Life Insurance Corporation of India (LIC) reported standout performances with quarterly net profits of ₹18,643 crore and ₹19,013 crore, respectively. For the entire fiscal year, SBI’s profit surged to ₹70,901 crore, while LIC posted ₹48,151 crore in net earnings.

In the energy sector, Coal India registered a Q4 profit of ₹9,604 crore. Indian Oil Corporation (IOC) trailed with ₹7,265 crore, while Oil and Natural Gas Corporation (ONGC), one of the major upstream explorers, also recorded a profit of ₹6,448 crore during the same period.

Power industry titans also posted good results. India's largest electricity generator, NTPC, registered a profit of ₹7,897 crore, and Power Finance Corporation earned ₹8,358 crore. Power Grid Corporation of India posted earnings of ₹4,143 crore for the three months to March.

Along with hefty dividend payments, these PSUs also add to the government revenue through hefty corporate tax payables.

Besides, the large-scale capital spending programs of these government-owned enterprises are essential drivers of economic expansion and job creation.

In a welcome fiscal progress, the government made its FY 2024-25 fiscal deficit target of 4.8% of GDP, as presented in the revised budget estimates, a reality, informed by figures published on Friday by the Controller General of Accounts (CGA).

The CGA stated that combined central government receipts of revenue from tax and non-tax sources amounted to ₹30.36 lakh crore, meeting 98.3% of the revised estimates. Much of the non-tax revenue originated from PSU profits.

Read also| Trump Sends Notices, Plans 25% Tariffs on Japan and South Korea Starting August 1

Read also| Markets Climb in Anticipation of India-US Trade Deal